Section 194IB in the Income-Tax Act -

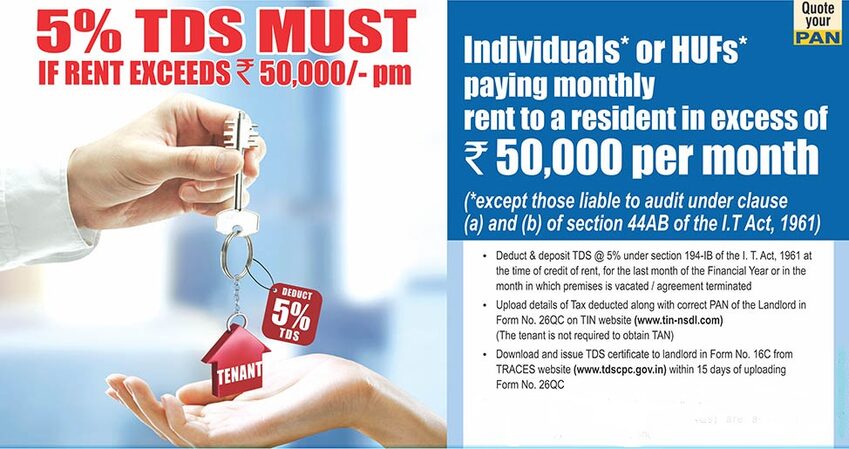

In the section 194-IB of the Income Tax Act, 1961, it has been said that all the transactions which will be effected from June 1, 2017, a tax will be deducted by the Tenant of the property at the time of making payment of rent to Landlord. This tax should be deposited to the specified Government Account through any authorized bank branches in India. The rate of TDS (Tax Deducted at Source) is deductible is @5% of the rent paid or payable. If the tenant/landlord is not a PAN Card holder then the rate of TDS will be @20% which depends on the maximum limit of the amount of rent payable at the month of March or last month of tenancy.

Salaried person or person who doesn’t have any income liable for tax audit are mainly covered under section 194IB.

Other Individuals or HUF which are not covered under this section, company, partnership firm, AOP (Association of Persons) and BOI (Body of Individuals) are required to deduct TDS from rent under section 194I.